Are you looking to invest in property but don’t have the funds? Or maybe you want to diversify your investment portfolio? Look no further than your self managed superfund (SMSF)! Buying a house through your SMSF can be a smart and savvy way to invest in real estate. In this blog post, we’ll cover what an SMSF is, how to buy property through it, and the benefits of doing so. Get ready for some valuable insights that may just change the way you think about investing!

What is a self managed superfund?

A self managed superfund (SMSF) is a private superannuation fund that you manage yourself. It’s regulated by the Australian Taxation Office (ATO) and allows you to control your retirement savings. You can pool your money with up to three other members, who are typically family or close friends.

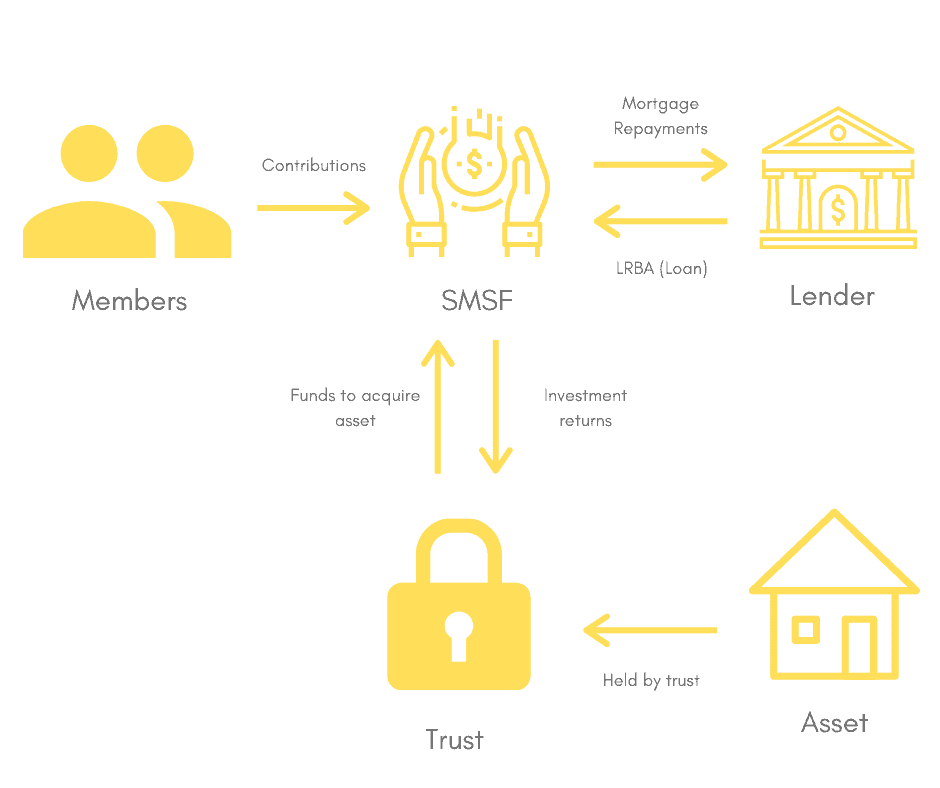

To set up an SMSF, you need to appoint trustees who will run the fund on behalf of its members. The trustees must be either individual people or a corporate entity. Once established, an SMSF can invest in various assets such as shares, cash, and property.

One of the key advantages of having an SMSF is that it gives you greater flexibility and control over your investments compared to traditional funds managed by financial institutions. You have more say in where your money goes, and you can tailor your investment strategy according to your needs.

However, managing an SMSF also comes with responsibilities such as ensuring compliance with legal obligations and keeping accurate records. That’s why it’s important to seek professional advice before setting one up or making any significant investment decisions through it.

How to buy a house through your SMSF

Buying a house through your self managed superfund (SMSF) can be a smart financial move if done properly. However, it’s important to know the steps involved in this process before diving in.

Firstly, ensure that your SMSF trust deed allows for property investment. If it doesn’t, you’ll need to update or amend the deed with the help of legal professionals.

Next, identify suitable properties and conduct thorough research on each potential investment option. Keep in mind that there are restrictions on what kinds of properties an SMSF can invest in – residential and commercial properties are generally allowed but not personal use assets such as holiday homes.

Once you’ve found a suitable property, make an offer and negotiate terms with the seller just like any other real estate purchase. It’s important to note that all contracts must be signed by the trustee of your SMSF rather than yourself personally.

Finance the purchase using funds from your SMSF account – this is typically done via cash savings or by obtaining a loan within the fund itself. Remember that transferring ownership of assets into an SMSF has tax implications so consulting with financial advisors is highly recommended throughout every step of this process.

The benefits of buying a house through your self managed superfund

Investing in property through a self managed superfund (SMSF) can offer many benefits. One of the main advantages is that it allows you to diversify your investment portfolio and have more control over where your money is invested.

Another benefit of buying a house through your SMSF is the potential tax savings. If the property is negatively geared, any losses can be offset against other income within the fund, potentially reducing the amount of tax payable on that income.

Moreover, when you retire and start receiving pension payments from your SMSF, any rental income earned from the property will be taxed at a concessional rate of 0%, meaning all revenue generated by renting out the property goes straight into your retirement nest egg.

In addition to these financial gains, investing in residential or commercial properties can also provide long-term capital growth for your SMSF as well as providing tenants with secure housing options.

However, before investing in real estate using an SMSF, it’s important to seek professional advice from financial experts who are knowledgeable about this type of investment strategy. They can help ensure that you understand all risks involved and guide you towards making informed decisions based on current market trends and regulations.

Conclusion

Buying a house through your self managed superfund can be an excellent investment opportunity. It allows you to diversify your portfolio and invest in a tangible asset that has the potential for capital appreciation. However, it’s important to remember that there are strict rules and regulations surrounding SMSF property investments, so it’s crucial to seek professional advice before making any decisions.

By working with a qualified financial advisor or mortgage broker who understands the complexities of SMSFs, you can ensure that your investment is structured correctly and complies with all legal requirements. With careful planning and guidance from experts in the field, purchasing property through an SMSF may be a smart move that helps secure your financial future.